In the healthcare sector, insurance is the breaking point for many. From a wide range of options, Medical Supplement Plans are a distinctive one that is mainly used by people who want complete coverage. Generally called Medigap plans, these policies were customized in order to meet the coverage gaps that were created by the traditional Medicare. This article will discuss what Medical Supplement Plans include and who needs them.

What medical supplement plans are?

Health supplement plans are special medical insurance policies designed to cover costs that Original Medicare does not cover financially. However, Medicare Part A and Part B are incomplete, leaving beneficiaries subject to out-of-pocket expenses, such as copayments, coinsurance, and contributions. Medigap plans fill the gap in expenses not covered by original Medicare, thus creating a safety net for the beneficiaries.

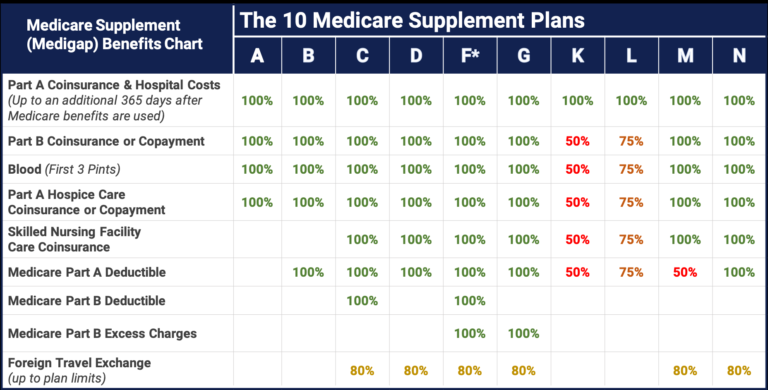

Understanding Coverage Options

These types of plans are available in diverse packages named after Alphabet, starting with Plan A and ending with Plan N, and they provide separate benefits. Take for example ACE Medicare Supplement Plan which offers the 5 best Medicare Supplement plans. This includes, for instance, Plan A that functions like typical medical care and Plan B which covers a lot more, including better facilities. Plan F and Plan G are the most extensive plans which cover the major portion of out-of-pocket cost, including the deductible and the balance referred to as excess charges which can be liability if you receive emergency medical care based on your country.

Eligibility and Enrollment

A registered Medicare Supplement Plan applicant must be enrolled in Medicare Part A and Part B. So, the recommended time to start a Medigap plan is during this open enrollment period, which begins within six months of turning 65 and enrolling in Medicare Part B. In this period, insurance companies are not allowed to deny coverage or charge the applicants higher premiums based on medical history.

Costs and Premiums

Although Medical Supplement Plans provide through-and-through coverage, premiums range based on factors such as age, address, and which plan you choose. Typically, the greater the scopes of the coverage, the higher the premiums are paid. On the one hand, paying higher premiums may sometimes result in lower out-of-pocket costs later on, which makes it a good saving opportunity for many patients.

Benefits and Flexibility

Another big merit of Medigap plans is the freedom they provide. Beneficiaries can seek healthcare services from any healthcare provider that accepts Medicare, without the fear of network limitations. More so, certain plans might also cover services that are not covered by Medicare, for example; emergency medical care during foreign travel.

Analyzing plans and Mature Decision-Making

With different Medigap plans offered, selecting the appropriate one may turn out to be a difficult task. Comparing all the 5 best Medicare Supplement plans is essential since you will need to pay close attention to the coverage, premiums and provider networks among other things. Apart from this, you should also evaluate your healthcare needs along with your financial situation to select the right plan according to you.